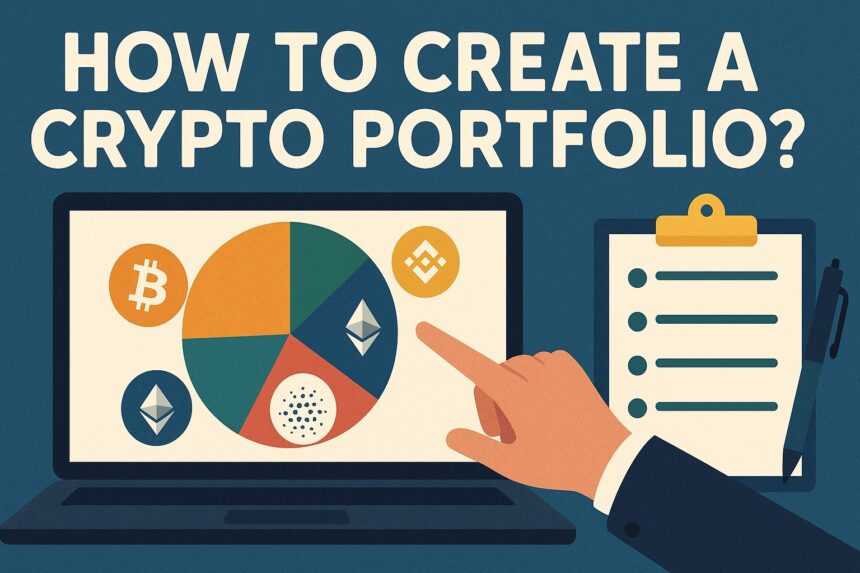

The most important thing before investing in cryptocurrency is to create a good portfolio.

A portfolio means which cryptos you have and in what quantity.

1. Why is a crypto portfolio necessary?

- To reduce risk

- To get better returns

- To create a balance by investing in different coins

- To withstand market fluctuations

2. How to get started?

Step 1: Decide your investment amount

Keep a lot of money wisely that you can lose. Crypto is very volatile.

Step 2: Make a goal

- Do you want to invest long term or

- Want to make profits in the short term?

3. Which cryptos to keep in the portfolio?

🔹 Bitcoin (BTC) – 40%

The most trusted and stable coin, it is called ‘digital gold’.

🔹 Ethereum (ETH) – 30%

The base of smart contracts and Dapps, the second biggest name in the blockchain world.

🔹 Mid cap and alt coins – 20%

Like Solana (SOL), Ripple (XRP), Chainlink (LINK) etc. These can give higher returns but the risk is also higher.

🔹 Small share – 10%

In low cap cryptos, new projects, NFTs or DeFi projects.

4. Track and update investments

- Check your portfolio regularly

- Balance when needed (e.g. if the price of a coin increases a lot, sell some)

- Keep an eye on market news and trends

5. Risk management tips

- Diversify – don’t invest all the money in a single coin

- Be patient – the crypto market is very volatile

- Avoid scams – beware of unknown and very high return projects

- Use a secure wallet – choose a hardware or trusted wallet to keep your crypto safe

Conclusion

As important as it is to create a crypto portfolio, it is more important to have the right plan and invest wisely.

Start with small steps, keep learning and improve your portfolio over time.

👉 What to read next?

- [How to create and keep a crypto wallet]

- [Long term vs short term crypto investing]

- [Top crypto investing tips in 2025]